Financial Highlights

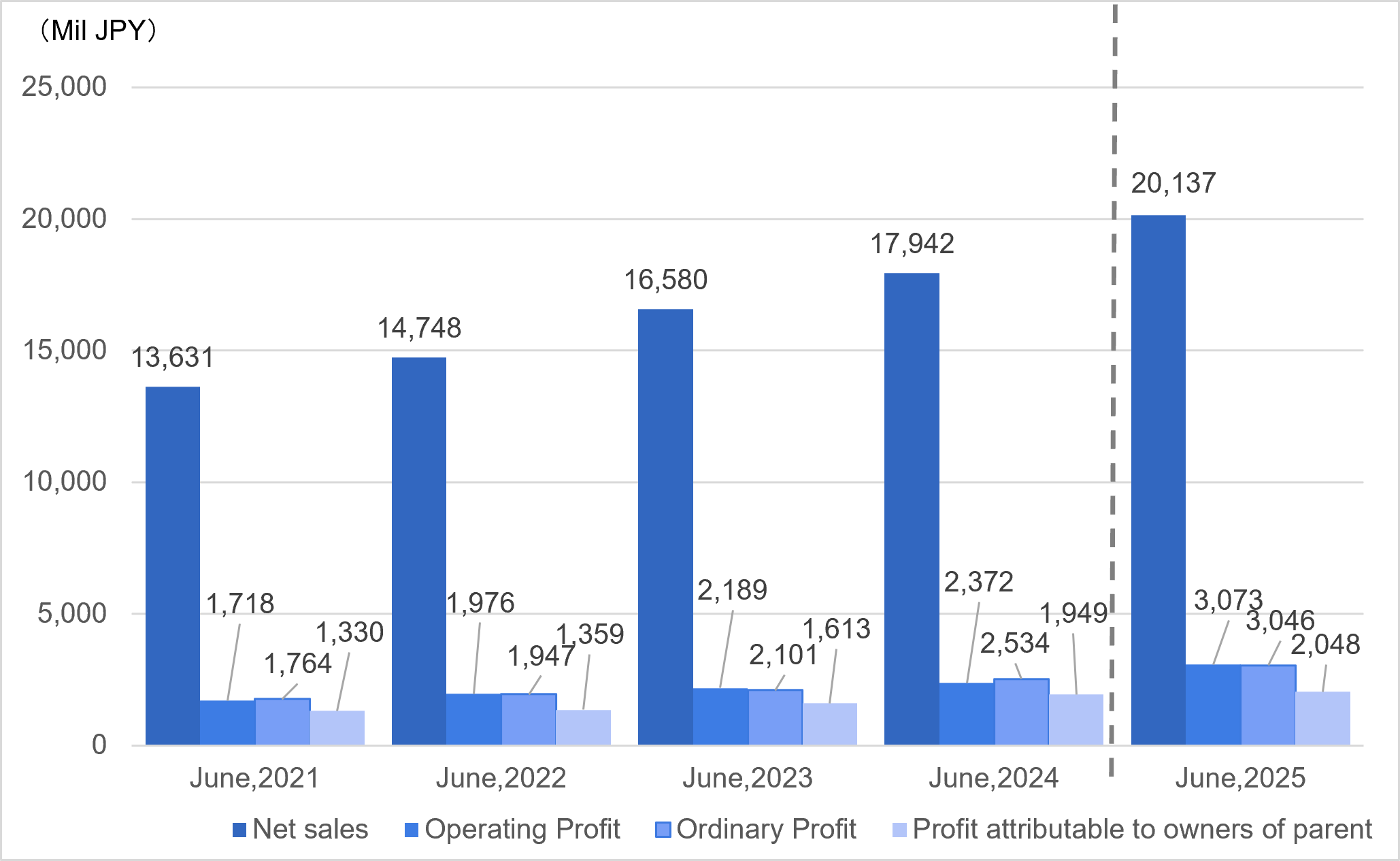

Consolidated results of operations

| Net Sales (Mil JPY) | Operating Profit (Mil JPY) | Ordinary Profit (Mil JPY) | Profit attributable to owners of parent (Mil JPY) | |

|---|---|---|---|---|

| FYE June 2021 | 13,631 | 1,718 | 1,764 | 1,330 |

| FYE June 2022 | 14,748 | 1,976 | 1,947 | 1,359 |

| FYE June 2023 | 16,580 | 2,189 | 2,101 | 1,613 |

| FYE June 2024 | 17,942 | 2,372 | 2,534 | 1,949 |

| FYE June 2025 | 20,137 | 3,073 | 3,046 | 2,048 |

[NOTE] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

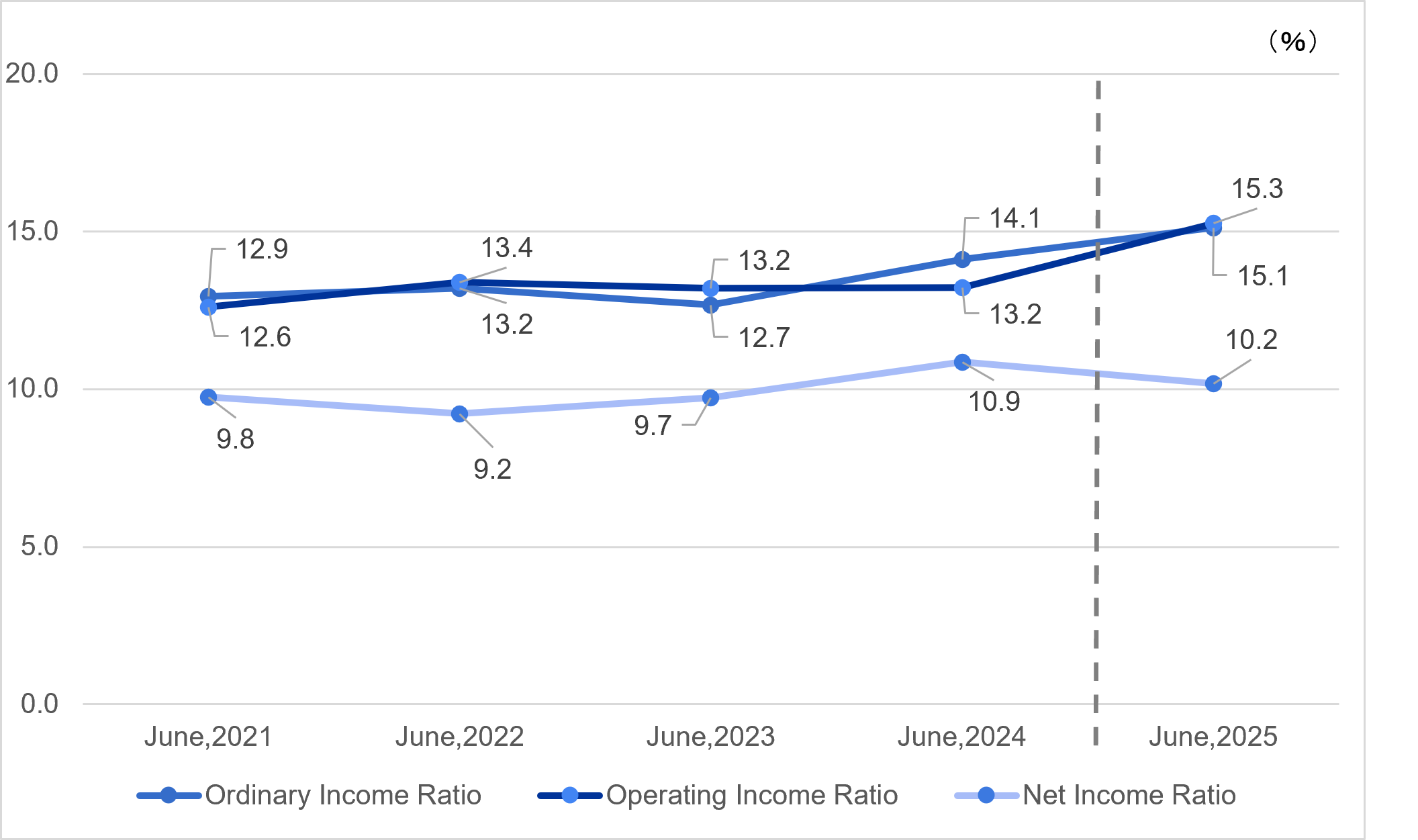

| Operating Income Ratio (%) |

Ordinary Income Ratio (%) |

Capital Adequancy Ratio (%) |

|

|---|---|---|---|

| FYE June 2021 | 12.6 | 12.9 | 9.8 |

| FYE June 2022 | 13.4 | 13.2 | 9.2 |

| FYE June 2023 | 13.2 | 12.7 | 9.7 |

| FYE June 2024 | 13.2 | 14.1 | 10.9 |

| FYE June 2025 | 15.3 | 15.1 | 10.2 |

[NOTE] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

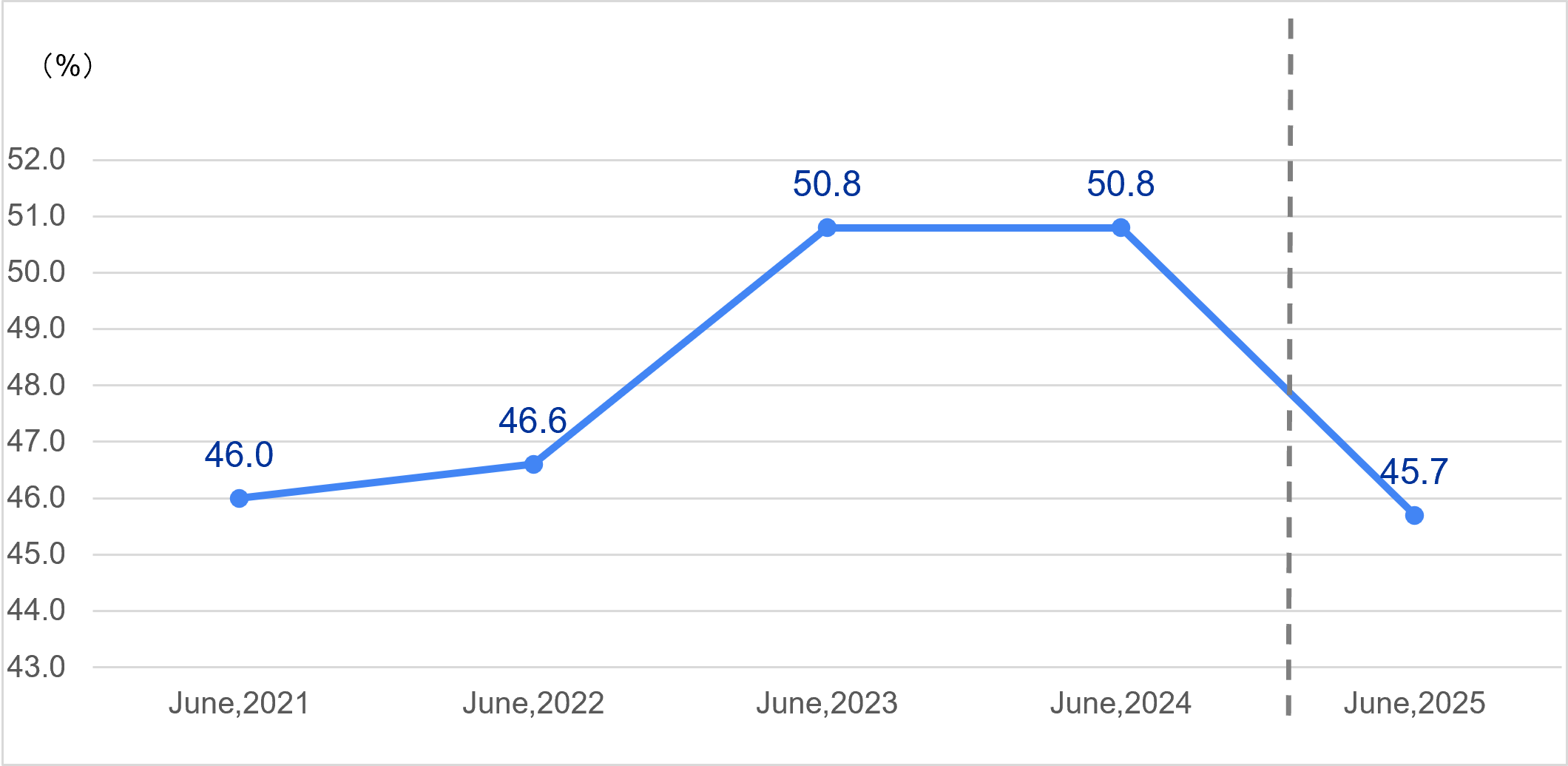

Capital Adequacy Ratio

| Capital Adequacy Ratio (%) | |

|---|---|

| FYE June 2021 |

46.0 |

| FYE June 2022 |

46.6 |

| FYE June 2023 |

50.8 |

| FYE June 2024 |

50.8 |

| FYE June 2025 |

45.7 |

[NOTE] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

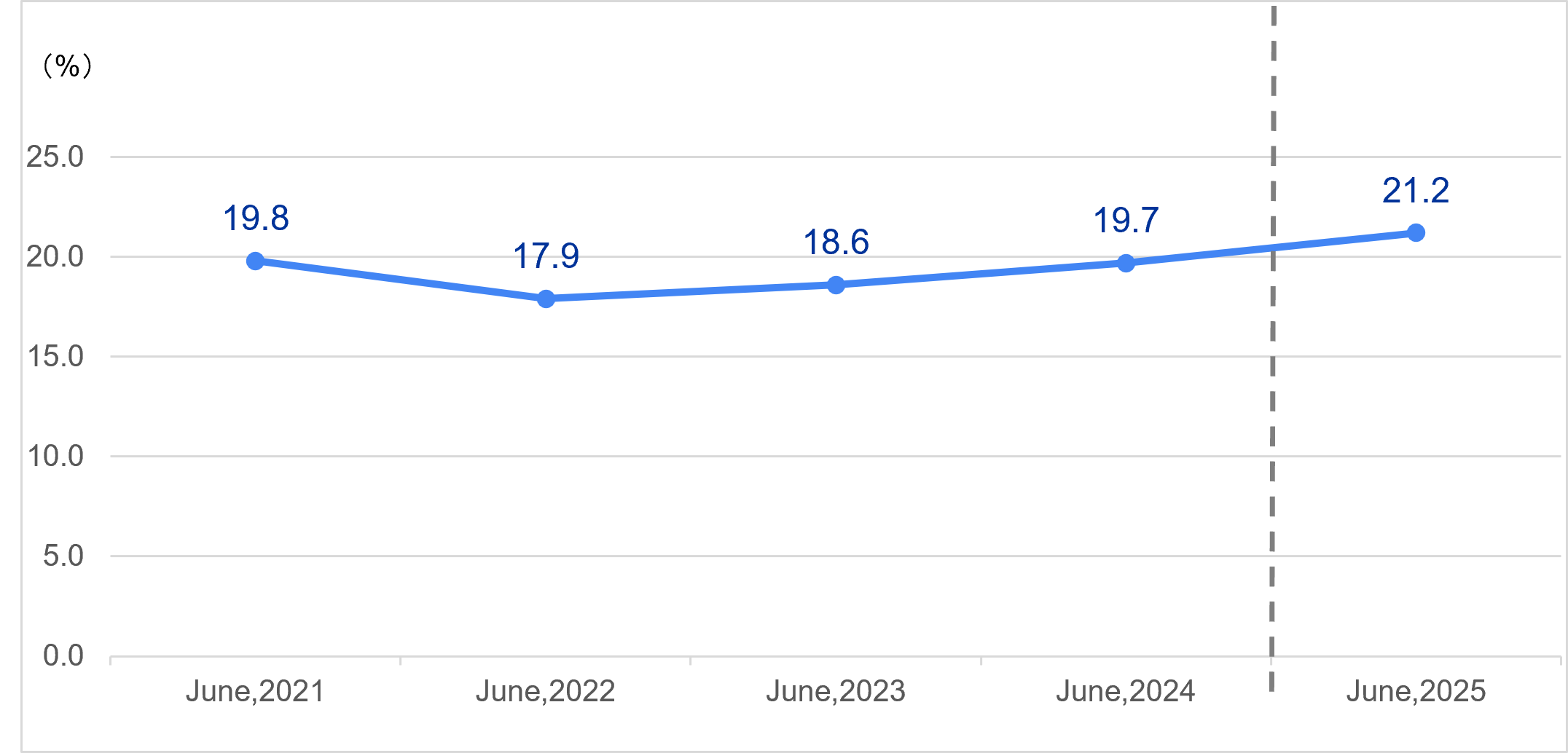

Return On Equity

| Return On Equity (%) |

|

|---|---|

| FYE June 2021 |

19.8 |

| FYE June 2022 |

17.9 |

| FYE June 2023 |

18.6 |

| FYE June 2024 |

19.7 |

| FYE June 2025 |

21.2 |

[NOTE] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

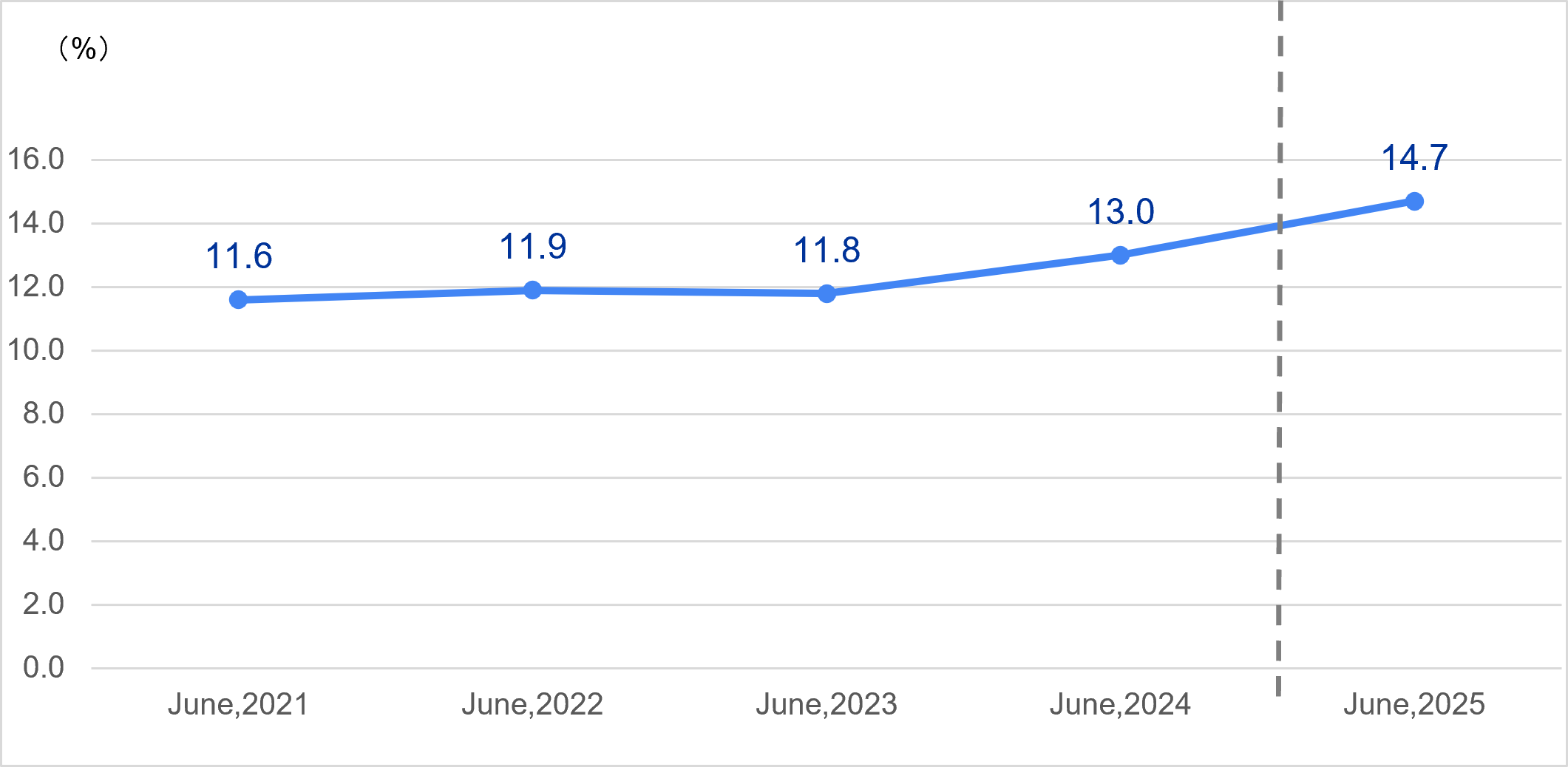

Return On Asset

| Return On Asset (%) | |

|---|---|

| FYE June 2021 |

11.6 |

| FYE June 2022 |

11.9 |

| FYE June 2023 |

11.8 |

| FYE June 2024 |

13.0 |

| FYE June 2025 |

14.7 |

[NOTE] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

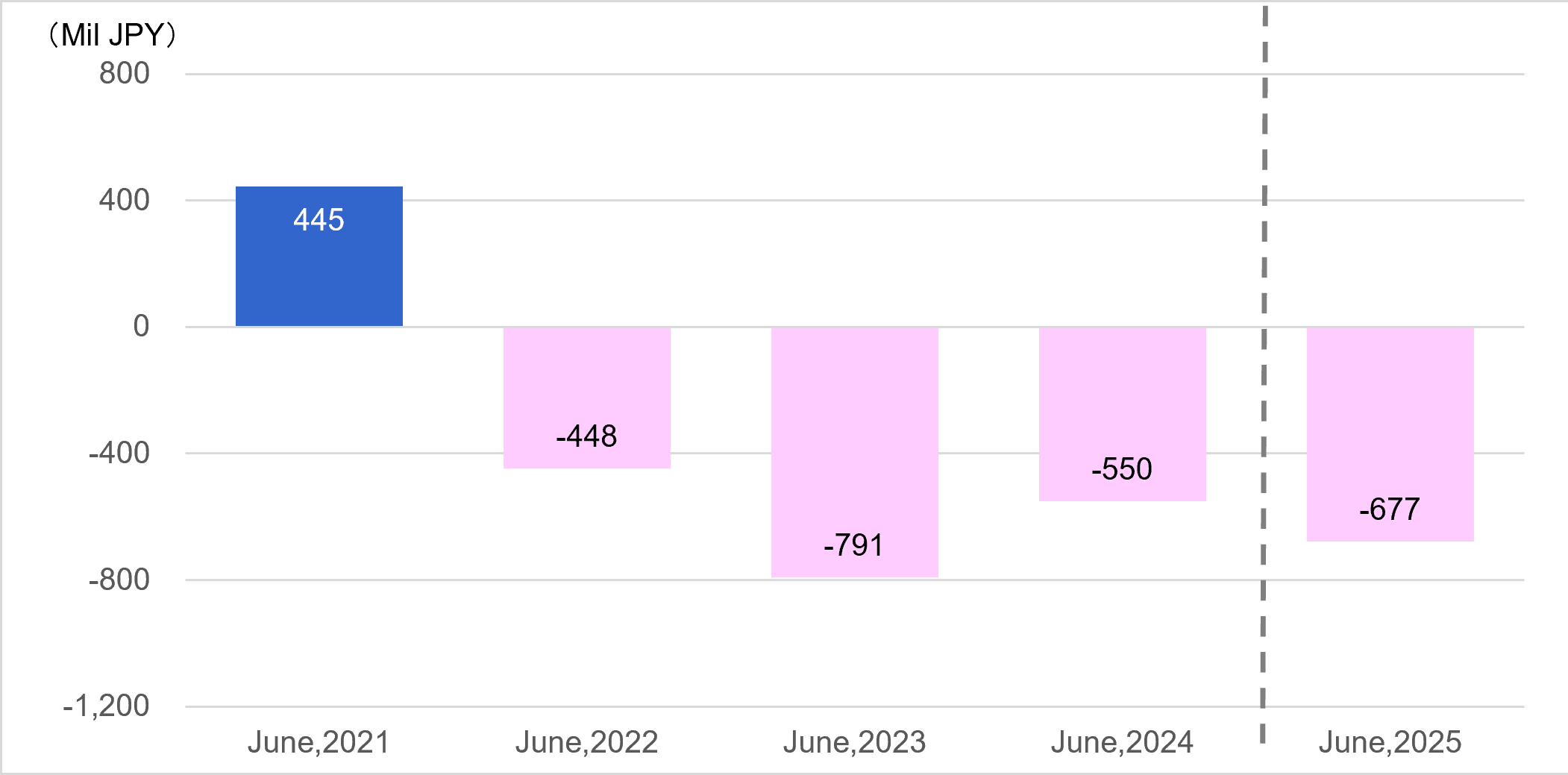

Net Interest-bearing Debt

| Net Interest-bearing Debt (Mil JPY) | |

|---|---|

| FYE June 2021 |

445 |

| FYE June 2022 |

-448 | FYE June 2023 |

-791 |

| FYE June 2024 |

-550 |

| FYE June 2025 |

-667 |

[NOTE 1] Lease liabilities are not included in Net Interest-bearing Debt.

[NOTE 2] Net Interest-bearing Debt includes ESOP trust borrowings of 677 million yen for FYE June 2021, 206 million yen for FYE June 2022, 393 million yen for FYE June 2023, 912 million yen for FYE June 2024 and 568 million yen for FYE June 2025.

[NOTE 3] Excess cash since FYE June 2022

[NOTE 4] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

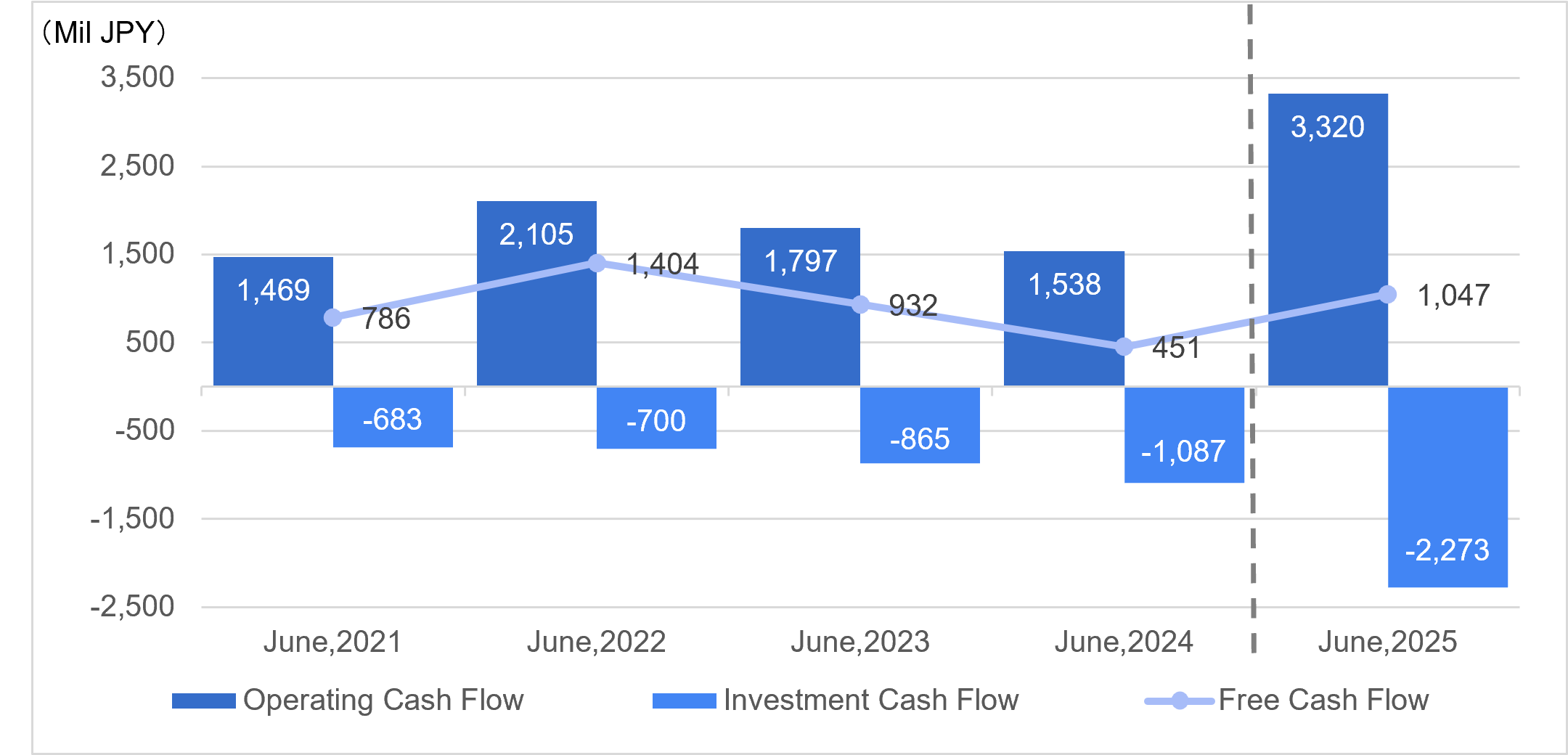

Cash Flows

| Operating Cash Flow (Mil JPY) | Investment Cash Flow (Mil JPY) | Free Cash Flow (Mil JPY) | |

|---|---|---|---|

| FYE June 2021 |

1,469 | -683 | 786 |

| FYE June 2022 |

2,105 | -700 | 1,404 |

| FYE June 2023 |

1,797 | -865 | 932 |

| FYE June 2024 |

1,538 | -1,087 | 451 |

| FYE June 2025 |

3,320 | -2,273 | 1,047 |

[NOTE] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

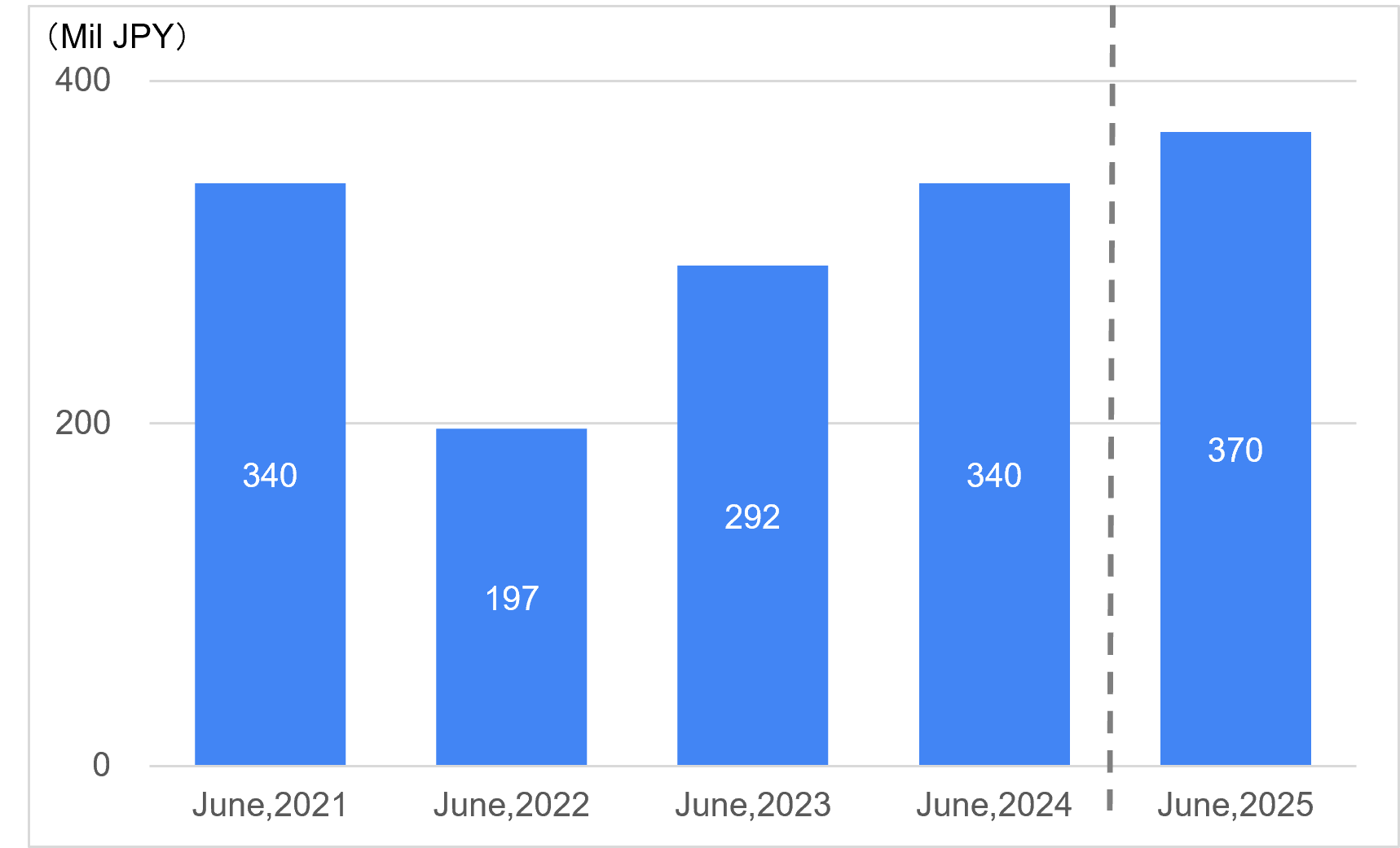

Research and Development Expenditure

| Research and Development Expenditure (Mil JPY) |

|

|---|---|

| FYE June 2021 |

340 |

| FYE June 2022 |

197 |

| FYE June 2023 |

292 |

| FYE June 2024 |

340 |

| FYE June 2025 |

370 |

[NOTE] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

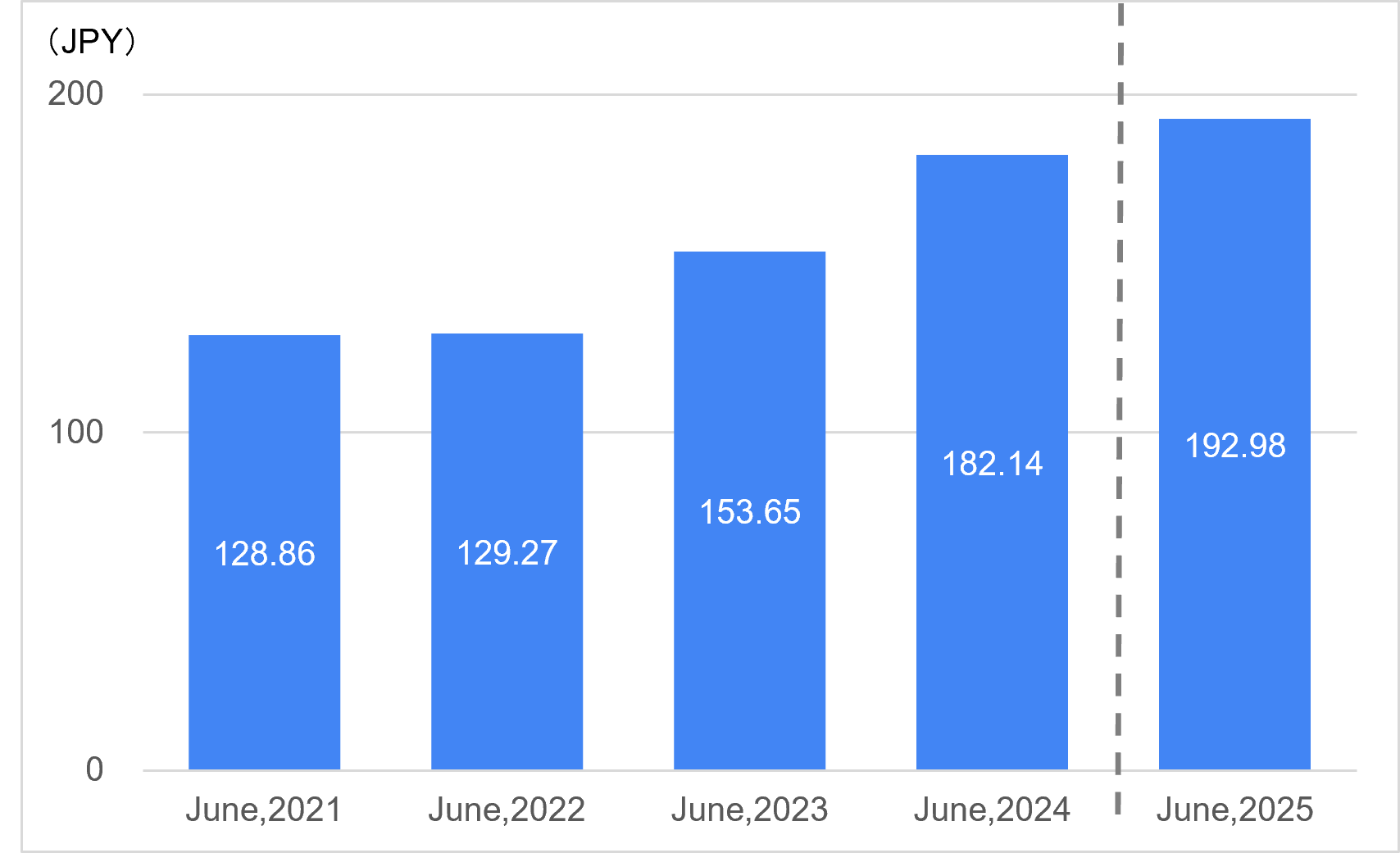

Earnings Per Share

| Earnings Per Share (JPY) | |

|---|---|

| FYE June 2021 |

128.86 |

| FYE June 2022 |

129.27 |

| FYE June 2023 |

153.65 |

| FYE June 2024 |

182.14 |

| FYE June 2025 |

192.98 |

[NOTE 1] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

[NOTE 2] The Company implemented a 1-for-2 stock split with a record date of February 28, 2025. As a result, per share information for the fiscal year ended June 2024 and prior periods has been retrospectively adjusted to reflect the effects of the stock split.

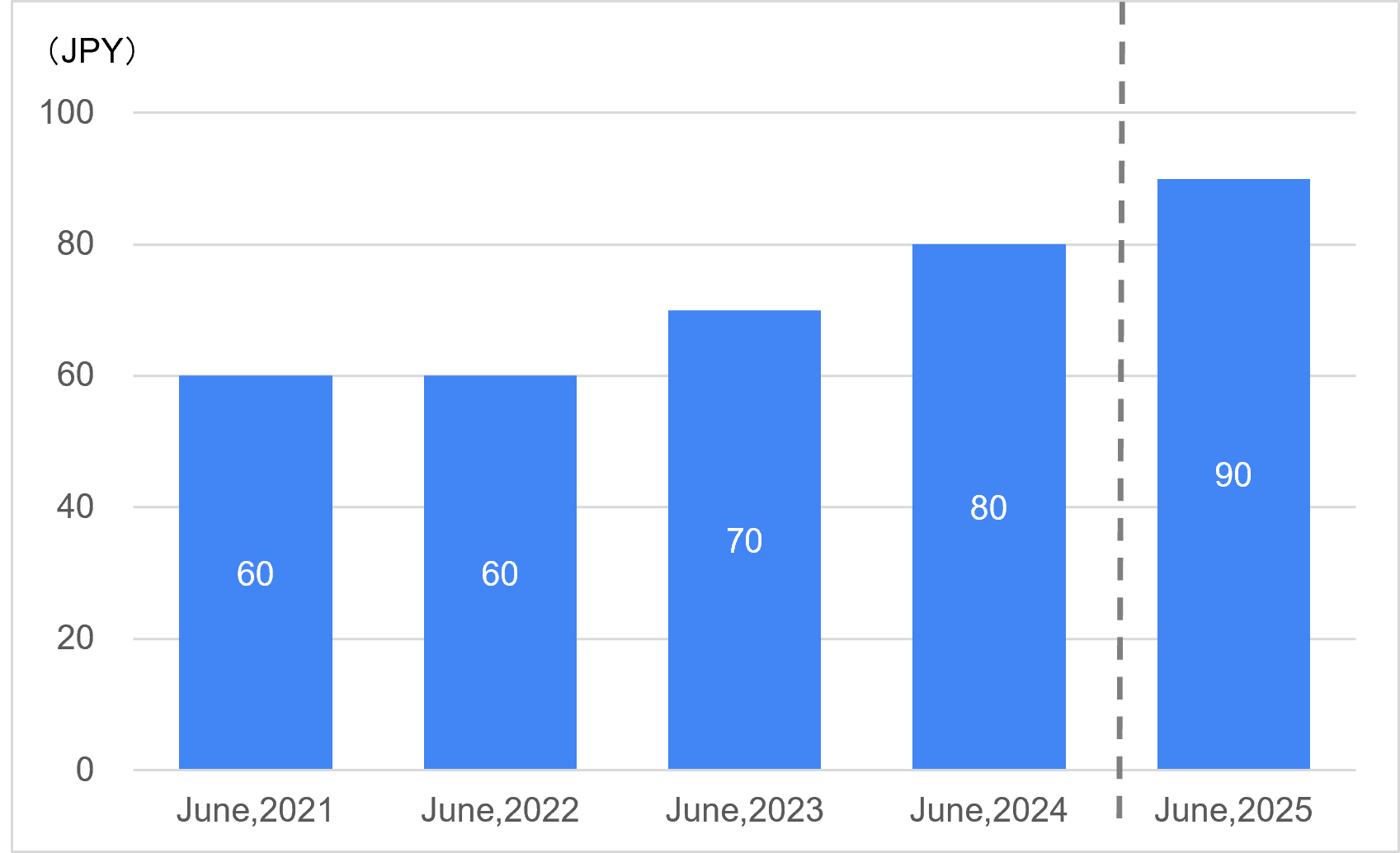

Indicated Dividend

| Indicated Dividend (JPY) | |

|---|---|

| FYE June 2021 |

60 |

| FYE June 2022 |

60 |

| FYE June 2023 |

70 |

| FYE June 2024 |

80 |

| FYE June 2025 |

90 |

[NOTE 1] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

[NOTE 2] The Company implemented a 1-for-2 stock split with a record date of February 28, 2025. As a result, per share information for the fiscal year ended June 2024 and prior periods has been retrospectively adjusted to reflect the effects of the stock split.

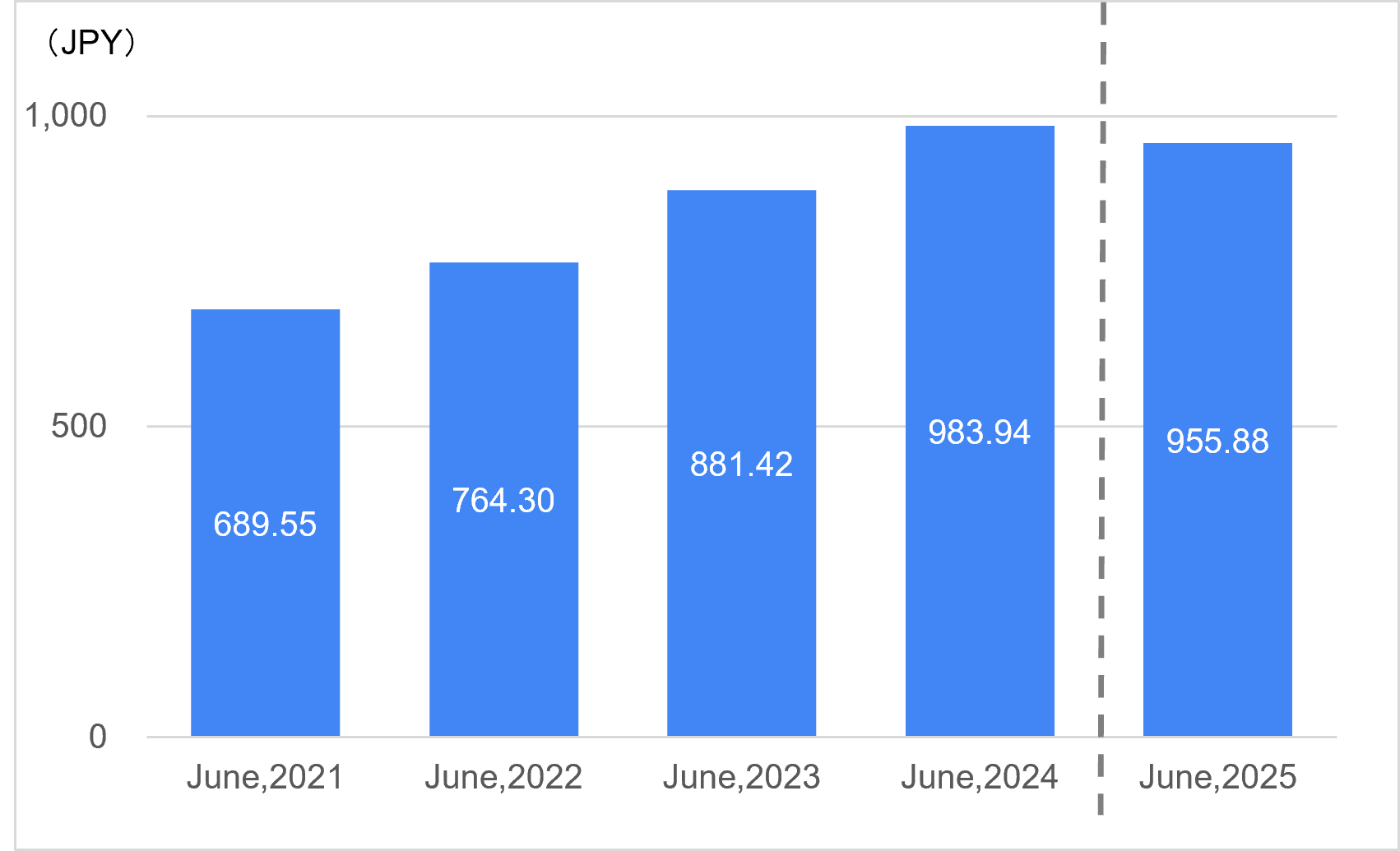

Book-Value Per Share

| Book-Value Per Share (JPY) | |

|---|---|

| FYE June 2021 |

689.55 |

| FYE June 2022 |

764.30 |

| FYE June 2023 |

881.42 |

| FYE June 2024 |

983.94 |

| FYE June 2025 |

955.88 |

[NOTE 1] Up to FYE June 2024, figures for KOZO KEIKAKU ENGINEERING Inc., which became a wholly-owned subsidiary on July 1, 2024 are listed.

[NOTE 2] The Company implemented a 1-for-2 stock split with a record date of February 28, 2025. As a result, per share information for the fiscal year ended June 2024 and prior periods has been retrospectively adjusted to reflect the effects of the stock split.